- Underwriter

- Posts

- 📈 $UNH: Down 50%, Loved by Buffet...is it a buy?

📈 $UNH: Down 50%, Loved by Buffet...is it a buy?

A note that neither Underwriter nor this newsletter provides investing or trading advice. Please consult with a financial professional before making investment decisions. This is purely for entertainment purposes. By reading, you agree to not take this as financial advice and assume all risk. Stock investing is risky and may lead to you losing some if not all of your investment.

📝 $20 for 45 Minutes of Your Time 📝

Hey friends,

We’re looking to connect with a few people to help shape what Underwriter builds next. In these sessions, you’ll get a chance to try out some of our latest prototypes and share your feedback. We still have a few openings for next week—if you’re interested, please fill out the short survey linked here!

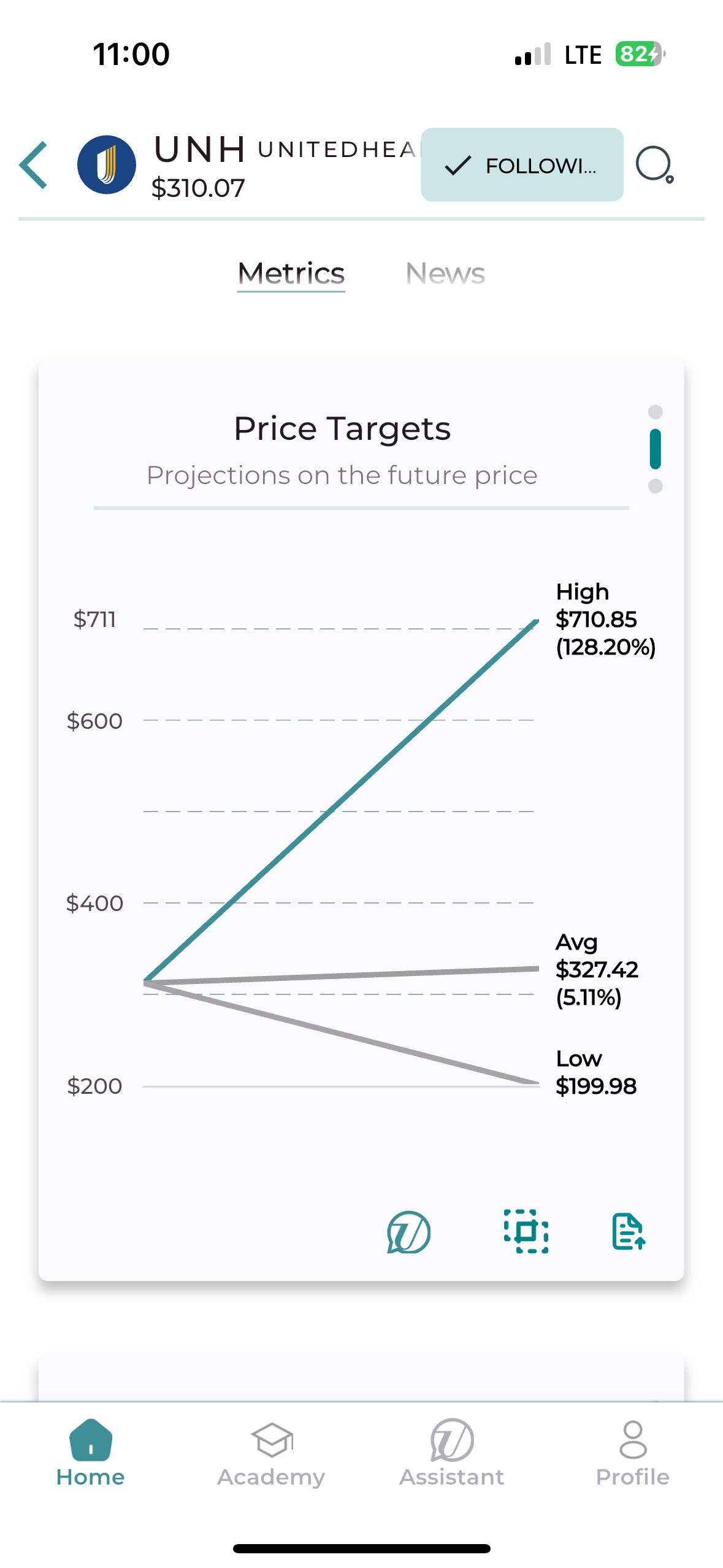

✨ Analysts and Banks Remain Positive

Despite the drop in price, some analyst are maintaining a BUY rating on the stock. JP Morgan has a price target of $310 (20%+). United Health Group is still an essential provider with a vast amount of market share. The price has dropped 60% from its 52 week high due to rising medical costs which cut its revenue outlook significantly. The company had underpriced plans that actually took on longer hospital stays and more intense procedures. To counter this, the company plans to:

|  |

🔮 Ask the Underwriter Assistant

✨Market TrendsHow do current healthcare trends impact United Healthcare's performance? | ✨ Revenue GrowthHow will United Healthcare manage rising costs? |

📈 Positivity from Hedge Funds

Hedge funds are increasing their stakes in United Healthcare. They see it as a quality business with strong moats. It is vertically integrated and has had steady financial performance. The U.S. population is steadily aging, driving an increase in Medicare enrollment. As a leading provider of Medicare Advantage plans, United Healthcare is strategically positioned to capitalize on this long-term demographic shift. The companies vertical integration (pharmacy benefits, care delivery, insurance) strengthen its market position. Warren Buffet bought 5 million shares in Q2. |  |

🚀 Buy: The case for buying United Healthcare is more cautious than in the past. The drop in price may be a nice entry for those with a long term view.

⏸️ Hold: Investors may be more cautious to see if United Healthcare’s leadership changes can get a hold of the rise in medical costs.

❗Sell: A sell case could be made for risk-averse investors who are concerned that health costs won’t be manageable in light of an aging population in America.

Explore Underwriter

A note that Underwriter and this newsletter is not investing or trading advice. These are stocks and information we find interesting. Please consult with a financial professional. By reading, you agree to not take this as financial advice and assume all risk. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of profit is made. In fact, you may lose your entire investment. We guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Underwriter. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.